The real estate market in 2015 has started off with much enthusiasm

and the feel of an early active spring is upon us. While there are a

variety of factors contributing to these market trends, interest rates

trending downward is certainly a KEY factor (see January Blog for

analysis).

I thought it’d be interesting and insightful to highlight a few key

trends in some market areas and analyze what is actually taking place

from a data standpoint.

Roseville-

Overall homes for sale increased throughout 2014 peaking with a total

of 464 homes for sale in October. The number of homes for sale as of

January 2015 was 283. That is a drop of homes for sale by approx. 39%!

Auburn- Likewise, there was a similar trend in Auburn with homes for sale peaking approx. in October. Since, homes for sale have dropped by approx. 32%!

Christian Valley-Meadow Vista-Colfax- Regarding acreage properties in the $200,000 to $300,000 price range, there is ONLY a total of 8 listings currently available compared to 46 sales in all of 2014. There is HUGE shortage of homes in this price range!

Grass Valley- Both the median and average prices increased over the last 2 months in December and January!

Nevada City- Between April to September 2014, there was approx. 6-7 months of inventory available, which was a 2 year high. Over the past 3 months, inventory has dropped back to this 3-4 month range, which was the general inventory range back in 2013.

Lake of the Pines- The price per SF reached a one year high

in December 2014 at $204 per SF. Overall, the last 4 months have

maintained an upper price per SF trend compared to first quarter of

2014.

Summarizing, while the above trends are encouraging

heading into spring, it’s is very important to always look at your

subject property’s immediate neighborhood. Over the past few months

analyzing various neighborhoods, I’ve

observed some subtle different trends within neighborhoods. While the

real estate market has many strong indicators, price is still essential.

Buyers are more educated now that ever and generally won’t pay more for

a home listed above market value.

Real Estate Tip of the Month: More

lenders are now requesting appraisers verify and comment that carbon

monoxide detectors, smoke alarms, and double earthquake straps are

installed. This is regardless of refinances/purchases OR

FHA/conventional loans. Some lenders will condition to have corrected

prior to close of escrow or loan. It’s a good idea to have these items

checked prior to the appraiser inspection.

If your are interested in a free comparative market analysis (CMA) for your local neighborhood, contact me for details.

Bryan Lynch, Realtor

Direct: 530-878-1688

Cell/Text: 916-765-6785

Email: BryanLynchRE@gmail.com

www.BryanLynchRE.com

License#01790398

CURRENT REAL ESTATE ACTIVITY:

www.1375BooleRd.com

MLS#14060416 -SOLD 1/16/2015 FOR $599,000.

Disclaimer:

All information deemed reliable but not guaranteed. The information is

meant entirely for educational purposes and casual reading only and is

NOT intended for any other use.

Friday, February 20, 2015

Wednesday, January 14, 2015

Auburn CA Real Estate Slow Down? Nope.

As we enter 2015 in the Auburn CA real estate market, I've basically

learned that the real estate markets in general are less and less

predictable. For example, looking back, I heard interest rates were

supposed to rise, but going into 2015, they have done the opposite and

have dropped. Looking back over the last 2014 quarter in

Auburn, CA, I was curious if buyer activity slowed in the Auburn market

area heading into 2015 and found the opposite to be true.

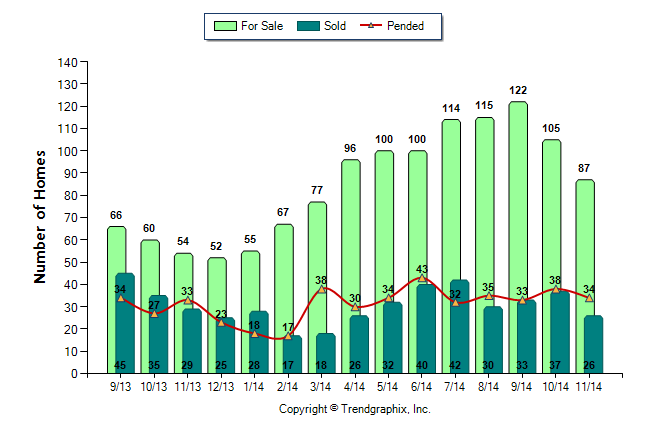

Sales vs. Listings-

Regarding the number of homes on the market in Auburn (area 12301),

while the trend showed an increase from January 2014 to September 2014,

inventory has decreased since this September's peak while the total

number of sales have been stable. Will this trend continue or will

inventory level off? We'll have to wait and see.

Summarizing, Auburn did not experience the typical late fall/holiday seasonal slow down that can typically happen this time of year. On the contrary, the market was very active and robust in the Auburn CA market areas. I'm curious how this recent trend will continue as 2015 begins. Observing the market as a whole, the upward price trend has been short-lived and may be reflective of many buyers taking advantage of the more recent downward interest rate movement. While somewhat simplistic, I believe closely watching interest rates and the ratio of inventory vs. pool of buyers will give an indicator of where the market may head going forward into 2015 for not only Auburn, but many surrounding market areas.

If your are interested in a free comparative market analysis (CMA) for your local neighborhood, contact me for details.

Bryan Lynch, Realtor

Direct: 530-878-1688

Cell/Text: 916-765-6785

Email: BryanLynchRE@gmail.com

www.BryanLynchRE.com

License#01790398

CURRENT LISTINGS:

www.1375BooleRd.com

MLS#14012596 -PENDING SALE $599,000

Disclaimer: All information deemed reliable but not guaranteed. The information is meant entirely for educational purposes and casual reading only and is NOT intended for any other use.

|

| Sales vs. Listings Auburn CA 2014 |

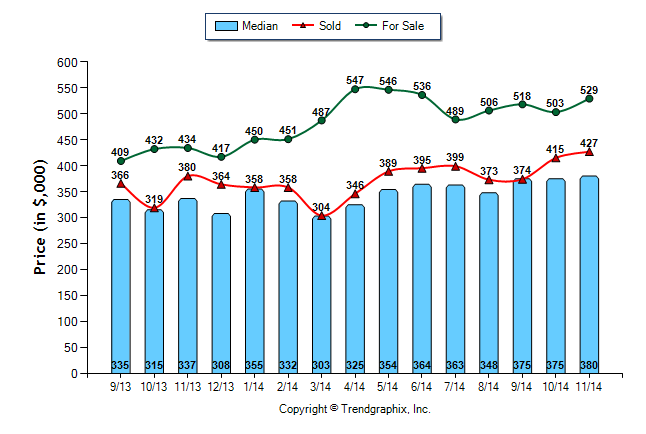

Median and Average Prices-

Regarding the Auburn average and median sales price, the graph shows

that these prices have been somewhat fluctuating and generally stable.

However, the average price has increased each month since September.

This coincides with the downward shift in inventory as noted above.

Sometimes the median and average charts can be impacted by a

disproportionate number of lower or higher priced sales. We'll soon find

out if this upward trend is short lived or will continue into early

spring.

|

| Median- Average Prices Auburn CA 2014 |

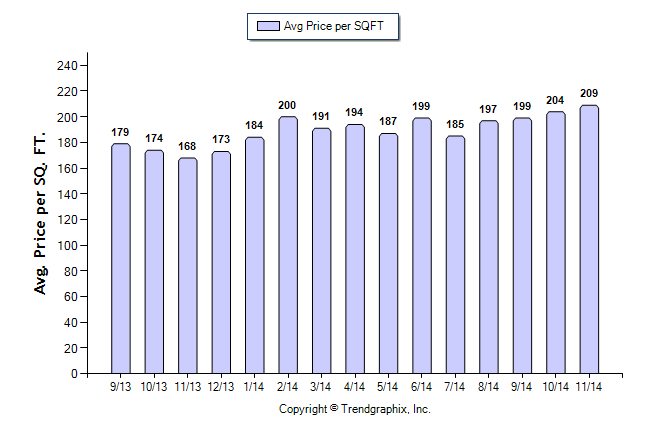

Price per Square footage (SF)-

Further, it is always good to cross check data. I like to also look at

the price per SF analysis to verify if the median and average price

trends are consistent with each other. In this case, the price per SF

also increased since September. So, this graph coincides and supports

the median and average sales price graphs.

|

| Price per SF Auburn CA 2014 |

Summarizing, Auburn did not experience the typical late fall/holiday seasonal slow down that can typically happen this time of year. On the contrary, the market was very active and robust in the Auburn CA market areas. I'm curious how this recent trend will continue as 2015 begins. Observing the market as a whole, the upward price trend has been short-lived and may be reflective of many buyers taking advantage of the more recent downward interest rate movement. While somewhat simplistic, I believe closely watching interest rates and the ratio of inventory vs. pool of buyers will give an indicator of where the market may head going forward into 2015 for not only Auburn, but many surrounding market areas.

If your are interested in a free comparative market analysis (CMA) for your local neighborhood, contact me for details.

Bryan Lynch, Realtor

Direct: 530-878-1688

Cell/Text: 916-765-6785

Email: BryanLynchRE@gmail.com

www.BryanLynchRE.com

License#01790398

CURRENT LISTINGS:

www.1375BooleRd.com

MLS#14012596 -PENDING SALE $599,000

Disclaimer: All information deemed reliable but not guaranteed. The information is meant entirely for educational purposes and casual reading only and is NOT intended for any other use.

Subscribe to:

Comments (Atom)